The Kreston GTA team

With their extensive experience and diverse professional backgrounds, our management team has all the necessary requirements to meet our clients’ requests.

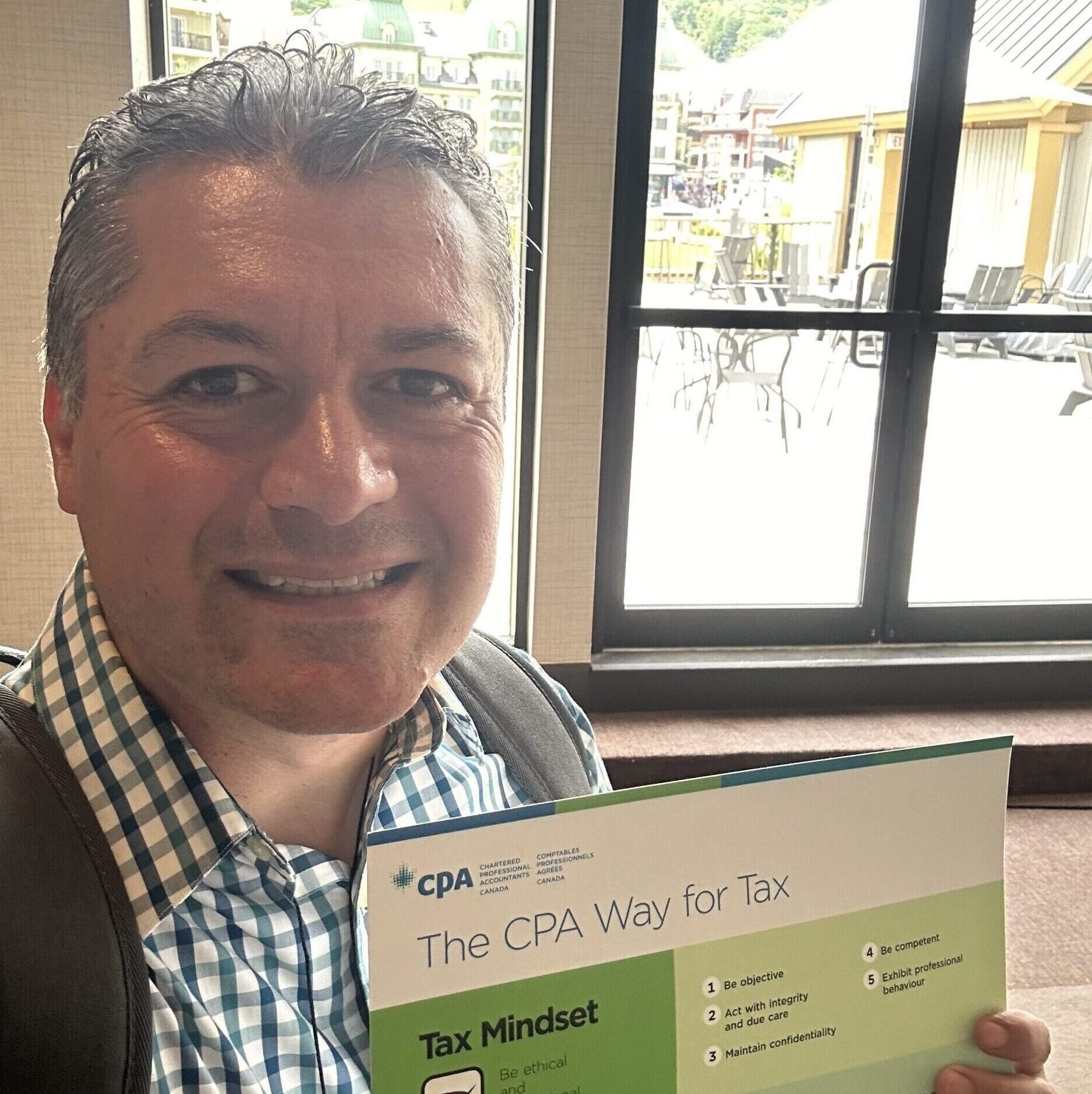

Spence Walker

Managing Partner

Spence joined Kreston GTA as a partner in 2004. Spence began his accounting career with a midsize accounting firm, where he gained experience in audit and consulting of Canadian and US public companies, a niche he continues to do a significant amount of work in.

Spence has a unique understanding of start-up and growth stage entities that require a solid strategy and roadmap to scale their business. He routinely services entities from start-up, through their growth phase, to merger or sale. Spence advises at every stage of your business, from funding growth, ensuring efficient, paperless accounting systems, designing of an effective corporate structure, maximizing the use of government grants and tax credits, to delivery of financial information required to grow your business.

Spence earned his BComm in 2001 from Ryerson University, his Canadian CPA, CA designation in 2003 and successfully completed the United States of America CPA exam in 2004. In 2013, Spence received his Certificate of Educational Achievement for completing the IFRS Certificate Program issued from the American Institute of Certified Public Accountants (AICPA).

During his spare time, Spence is an avid golfer and home cook who enjoys keeping up with culinary trends.

Jim Sandiford

Partner, Canadian and US Tax

Jim graduated from the University of Toronto and completed his CPA, CA designation at KPMG in 1979. He was a partner of McCluggage & Smith, which merged with Kreston GTA in 2010. His clientele includes virtually all commercial and non-profit sectors. A specialty of Jim is in providing assurance and related services to entities in the vehicle financing and leasing industry. Jim has performed audits, reviews and compilations as well as consulting on the nuances of the financial statements provided to industry lenders and their specific requirements.

Jim completed the in-depth tax course and provides a wide range of personal, estate and corporate income tax services. Jim is also a U.S. CPA and provides tax and accounting services to U.S. citizens and companies.

Apart from advising many clients over the years, Jim’s community involvement involves being the Chartered President and current Treasurer of the Rotary Club of Markham Sunrise Inc. Jim was awarded Rotary’s highest honour, twice receiving the Paul Harris Fellow Award for his community service. Jim currently chairs a City of Markham Committee and is the Chair Person of the Markham Santa Claus Parade.

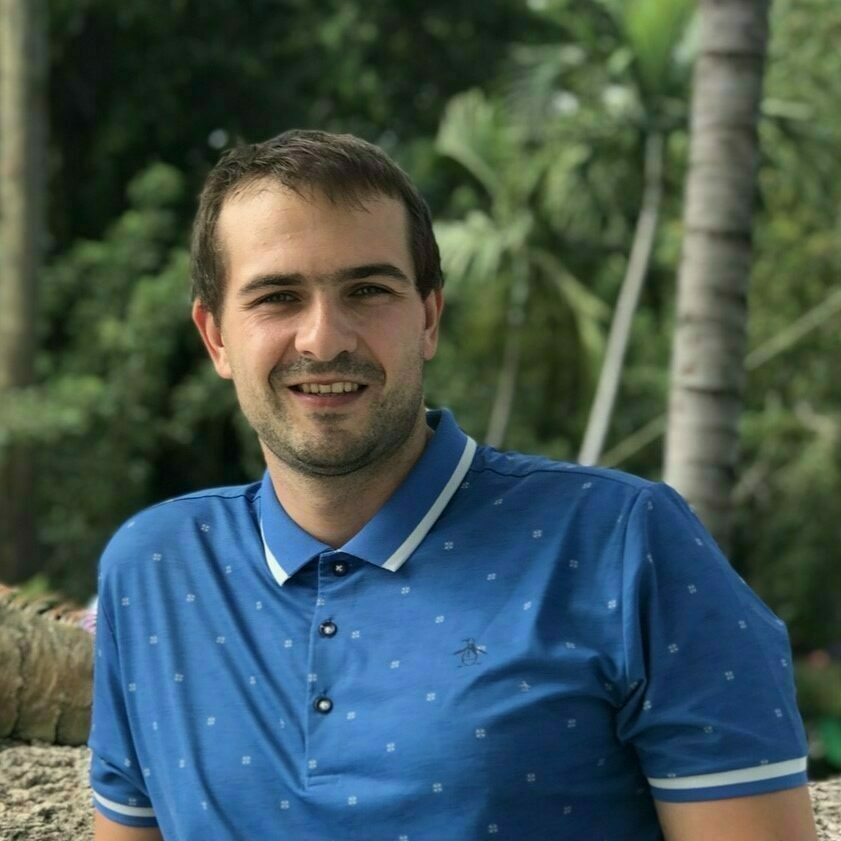

Jonathan Mazzuca

Partner, Audit

Jonathan joined Kreston GTA in 2009. He is currently the partner on many public, private company and not-for-profit organization assurance engagements. Jonathan has a thorough knowledge of Canadian Accounting Standards, Canadian Accounting Standards for Not-For-Profit Organizations and Public Company Accounting Oversight Board standards.

Jonathan graduated from Rotman Commerce at the University of Toronto and obtained his CPA, CA designation in January 2010.

Jonathan is an avid golfer, enjoys playing hockey and volunteers his time with his local parish, St. Norbert’s Catholic Church.

Akil Pervez

Partner, Public Companies

Akil is a seasoned Audit Partner who has worked in public accounting across multiple geographies for almost 15 years (including Canada, the USA, and the UAE). Akil has lead audit teams on various large US integrated audits during his 10-year tenure with a big 4 audit firm, as well as on various go-public entities and mid-sized companies, across a variety of industries, primarily technology, engineering, construction and healthcare.

Akil earned his FCCA (U.K.) designation in 2011, United States of America CPA designation in 2018 and Canadian CPA, CA designation in 2020.

Akil also earned his Master of Science in Professional Accountancy from University of London (U.K.) in 2018.

Balaji Katlai

Partner, Tax

Bal provides value add advice on tax planning and advisory assistance for Canadian businesses and individuals. His experience includes owner managed business, professional corporations, start ups to private mid market segment.

Bal is passionate about tax and tax education and contributes to the Canadian tax issues of topical interest; some of these articles are also cited within PITA for specific legislation. Bal has presented on tax matters in regional tax conference hosted by the Canadian Tax Foundation as well as in different tax network forums. He is also an instructor for select tax courses provided by CPA, Alberta and for the CPA In-depth tax program.

An experienced tax specialist (with a farm background) said to me – “A farmer dies when he stops planting”…Bal feels a tax professional dies when reading and learning stops!

In addition, Bal has a rich experience in the area of business tax incentives (such as SR&ED, OIDTMC, Quebec’s E-business and multi-media tax credits), inbound tax planning for technology corporations and tax matters specific to technology companies.

Prior to a career in corporate tax, Bal was a trained physicist specialized in neutrino physics, and early Universe cosmology. He worked primarily in Europe before moving to Montréal, Canada – enjoyed the gig as long as it lasted with 28 peer reviewed papers (mainly in journals part of The American Physical Society) – Presently, his work is also archived in SLAC, Stanford.

Joanne Smith

Consulting Partner, Private Entities and Not-for-Profits

Joanne joined the firm in 2010 through a merger with McCluggage & Smith, where she was a partner.

Joanne is a graduate from York University and subsequently earned her CPA, CA designation in 1985.

During her career, Joanne has worked with a diverse clientele ranging from owner-managed real estate companies to religious charitable organizations.

Joanne also provides a wide range of accounting and tax services and has increasingly been involved in estate tax work.

Joanne continues consulting with current clients and mentoring members of the Kreston charity and not for profit team.

Sarmen Khatcherian

Managing Director, SR&ED and Government Incentives

With over 14 years of SR&ED tax credit consulting experience, Sarmen has helped hundreds of startups and established companies realize their innovation funding potential. He holds an advanced diploma in Mechanical Engineering Technology (Automotive Manufacturing option) from Georgian College and is an active member of the Ontario Association of Certified Engineering Technicians and Technologist (O.A.C.E.T.T) as a Certified Engineering Technologist (C.E.T.).

During his time with Kreston GTA, Sarmen has provided expert SR & ED advice for a multitude of industry sectors including telecommunication, advanced manufacturing, dental, clean tech, mining technology, artificial intelligence, hydrogen research, food and beverage, and software/IT development.

Sarmen has an extraordinary love for fishing, playing guitar, and is an amateur history buff.

Robert Kinsman

Manager, Private Entities

Rob graduated from York University in 1978 and earned his CPA, CA designation in 1985. Over the next 25 years he worked in industry at the controllership level for public and private companies primarily in the telecommunications industry.

He returned to public accounting and joined Kreston GTA in 2011. He currently manages all private company engagements, including compilations, accounting and bookkeeping and corporate tax planning.

In his spare time, Rob enjoys fitness, family and travel.

Jon Berghout

Manager, Private Entities

Jon joined Kreston GTA in 2021 and has over 25 years experience working in CPA firms. Jon has extensive knowledge of corporate and personal tax as well as corporate yearend engagements. He currently manages private company engagements.

Jon holds a BSc in Computer Science and Environmental Science from Trent University and obtained his CPA, CGA designation in 2011.

Jon was born in Victoria, B.C. but has lived in Ontario most of his life. In his spare time, he enjoys reading, mountain biking, hiking, and spending time with his family.

Joseph Falcone, CPA, EA

Manager, Private Entities

Joseph joined Kreston GTA in 2024. He currently manages private company engagements.

Joseph has obtained both the CPA and EA designations. He is client-centric and brings extensive public accounting experience, including 9 years within the Big 4 Accounting Firms. Joseph has extensive tax knowledge of domestic corporate and personal tax as well as Expat and US personal tax.

Joseph was born and raised in Ontario. In his spare time, he enjoys teaching at the CPA Canada In Depth Tax Course, gardening, watching soccer, ice skating, cycling and most importantly spending quality time with his family.

Alexey Koretskiy

Manager, Public Company Audit

Alexey leads the engagement teams of a number of private and public entities both in Canada and internationally. He is a qualified account (Fellow Chartered and Certified Accountant in the UK, in addition to being a Certified Accounting Professional in Ukraine) and has recently successfully passed CFA Level 1 exam which serves as a testament to his dedication to continuous professional development.

Drawing upon a remarkable career spanning over 15 years, Alexey’s expertise extends across accounting, finance, audit, and consulting. Notably, he spent more than a decade honing his skills at a prestigious big-4 audit firm, where he garnered invaluable insights both locally and internationally, including in North America and the Caribbean, working on US GAAP and IFRS clients for which the audits have been carried out under both IAS and US GAAS (PCAOB) audit standards. This global exposure allowed him to participate in countless audits, further solidifying his reputation as a seasoned professional.

Alexey’s journey commenced in 2007 as an auditor for a distinguished local Ukrainian accounting firm. He later transitioned to the accounting side of the business, progressively ascending to the role of Chief Accountant, where he successfully managed a finance team of 10 individuals. During this period, he demonstrated his prowess in handling IFRS financial statements for the company. Driven by a relentless pursuit of professional growth, Alexey returned to the realm of auditing, making significant contributions to PricewaterhouseCoopers (PwC) for over a decade. His exceptional leadership skills were evident as he spearheaded the audit effectiveness group at PwC Ukraine, collaborating closely with the Central European Cluster to enhance the efficiency and efficacy of audits. Alexey also dedicated nearly 10 years to Grant Thornton and PricewaterhouseCoopers in the Caribbean, acquiring extensive experience in working on a diverse portfolio of clients encompassing banks, hotels, oil and gas companies, investment funds, asset managers, retail businesses, and insurance firms. His expertise in handling US GAAP and IFRS engagements further solidified his standing in the industry.

Linda Gardiner

Client Manager

Linda joined the firm in 2018 through a merger with J.G. (Greg) Short, CPA, CA, where’s she’s been the client manager and coordinator of many aspects of the business since 1993, the year that Greg Short began his practice.

Linda is based out of our Aurora location and is very knowledgeable in Canadian personal tax, private-enterprise small business tax, and assists on many estate engagements.

If you’ve been to the Aurora office, you may know her by her FIAT 500 with spiffy eyelashes, and you may have even met her visiting golden retrievers that like to provide comfort to clients during the tough tax conversations at tax season!

When she’s not knee deep in tax season, Linda hits the hiking trails in York Region with her husband and dogs, enjoys a good TRX class at the gym and loves all things food!

Minal Sinha

Manager, Private Entities and Not-For-Profits

Minal joined Kreston GTA as an audit senior in 2013. Minal began his accounting career with a small accounting firm, where he gained experience in personal and corporate taxes, audits and reviews of Canadian private companies, not-for-profits and charitable organizations. Minal’s focus has been on charitable and not-for-profit organizations since joining Kreston.

Minal earned his BComm in 2006 from Dalhousie University and his Canadian CPA, CA designation in 2014.

Minal is fully remote and lives in Nova Scotia where he is establishing a Kreston satellite office. During his spare time, Minal enjoys swimming, paddleboarding, yoga and cooking.

Yehor Sukhenko

Manager, Public Company Audit

Borys has led engagement teams for numerous public entities, and he is an experienced audit and finance professional with a dedicated service record spanning 14 years. He excels in challenging environments and consistently delivers outstanding results. His commitment to achieving excellence is unwavering.

Borys has worked across multiple geographies, including Canada, the USA, UK, and Ukraine. During his 9-year tenure with a PwC firm, he served as an Engagement Manager on various large audits. Additionally, he took on the role of the country audit technology and methodology champion, leading cost-saving initiatives at PwC. Borys also held the position of Head of Internal Audit at one of the world’s top-10 metals producers.

Borys is curious to resolve all kinds of conundrums across all operations. He has a passion for solving problems with integrity, authenticity, courage, and innovation.

Professional Designations

- Chartered Certified Accountant (ACCA, UK)

- Certified Internal Auditor

- CPA Ukraine

GeorgiAna Radu

Manager, Bookkeeping and Payroll

Georgiana joined Kreston GTA in 2018 and manages the cloud bookkeeping and payroll department with a focus on client management and process improvement. She graduated with Honors from Brock University and continued her education in Accounting at Seneca College and received the Payroll Compliance Professional Certification from the National Payroll Institute. Georgiana also holds training certifications in QBO, Hubdoc, Expensify, Plooto, Payment Evolution and is fluent in Romanian and Spanish.

Georgiana’s extensive background in banking focused on both financial investments as well as borrowing has proven beneficial to her clients especially during the last few years where government grants were implemented.

On her free time Georgiana loves to spend her time with her boys and Mexican rescued dogs, enjoys Latin dancing, paddle boarding or skiing depending on the season and travels to her second home in Playa del Carmen, Mexico as much as possible.

Jamie Allman, CIM

COO

Jamie joined Kreston GTA as COO in April 2024. He is the lead on HR, Operations, IT and Marketing.

Prior to joining Kreston GTA, Jamie spent almost 10 years each at Scotiabank and Sun Life, along with another 10 years in the Wealth Management space. With a major focus on working with Retail Wealth Advisors, Jamie also spent time developing his skills in HR Learning, Product Development/Management and leading a large back-office Operation.

Jamie has spent his life in Toronto and enjoys golf, hiking, and spending time with his two sons and extended family.