Canada’s 2025 Budget: Major Enhancements to the SR&ED Program

November 5, 2025

Sector:

The federal budget unveiled on November 4, 2025, signals one of the most significant updates to the SR&ED program in over a decade. These reforms aim to strengthen Canada’s innovation ecosystem by making the SR&ED tax incentive faster, more generous, and more inclusive for companies of all sizes.

Effective Dates & Scope

The proposed changes apply to taxation years beginning on or after December 16, 2024.

Key Changes at a Glance

-

Enhanced Refundable Credit Expansion

The expenditure limit for the enhanced 35% refundable tax credit is increasing (for eligible corporations) from $3 million to $6 million. See below for a simplified example:

- Example: Company XYZ with:

- 6M in SR&ED expenditures

- Taxable capital <10M

- Prior year taxable income > qualifying income limit

Current SR&ED Limits New SR&ED Limits Federal Refundable Credit $1,050,000.00 $2,100,000.00 Federal Non-Refundable Credit $450,000.00 – TOTAL FEDERAL SR&ED CREDIT $1,500,000.00 $2,100,000.00 - Company XYZ with $6 million in SR&ED-eligible expenditures would previously have claimed $1.05 million in refundable credits (at the 35% enhanced rate) plus $450,000 in non-refundable credits (at the 15% base rate). Under the new regime, that same company would claim $2.1 million, all refundable.

- Example: Company XYZ with:

-

Higher Phase-Out Thresholds

The threshold for taxable capital employed (which phases out the enhanced rate) is increasing from $10–$50 million to $15–$75 million, giving scaling firms more headroom before the enhanced rate is reduced or lost.

-

Broader Eligibility

For the first time, Canadian public corporations (not just Canadian-controlled private corporations) will be eligible to access the enhanced 35% refundable rate.

-

Capital Expenditures Return

Capital costs used for SR&ED activities are again eligible for both the SR&ED deduction and investment tax credit. This reverses previous restrictions.

-

Modernized Administration (Effective April 1, 2026)

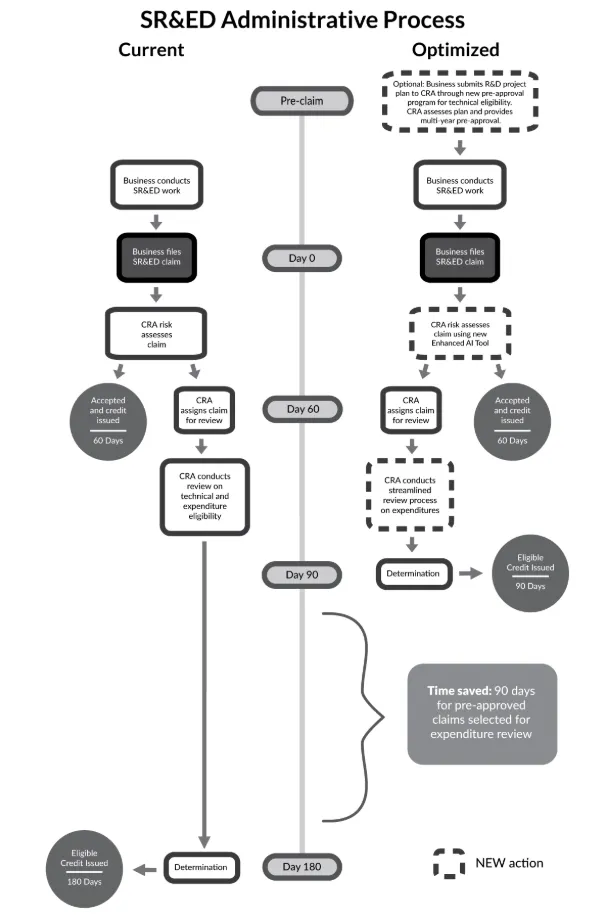

The reforms include process improvements for the Canada Revenue Agency (CRA): an elective pre-claim approval process before undertaking any work or incurring costs (reducing review times from 180 days to 90 days), AI-supported risk screening (to expedite low-risk claims), and a streamlined claim form (Form T661) with simpler documentation requirements.

Why It Matters

Together, these changes represent a major push toward reinforcing Canada’s R&D capacity. According to government estimates, the enhancements amount to around $440 million in additional annual SR&ED investment and are expected to generate approximately $1.2 billion in economic output each year – roughly a 3-time return. Whether you are a scaling CCPC or a publicly listed innovator, this is a moment to revisit your SR&ED strategy.

What to Do Next

If your company is undertaking technology development, process-improvement R&D, or other experimental work, now is the time to:

- Review your project budget and consider if previously ineligible expenditures (capital equipment) might now qualify.

- Assess whether your legal structure (public vs private) or taxable-capital/gross-revenue thresholds mean you could benefit more under the updated rules.

- Ensure your documentation practices are in place, as CRA is signalling more streamlined reviews but still emphasising systematic work and proper recoding of R&D investment.

- Monitor legislation: while these changes were announced, they are still subject to legislative approval and may change.

Important Caveat

If a federal election is called before the Budget implementation, or if the enabling legislation is delayed or modified, these changes could be delayed or altered. Plan accordingly.

How Kreston GTA LLP Can Help

At Kreston GTA LLP, our SR&ED and Incentives team helps businesses:

- Maximize refundable credits under the new rules.

- Identify eligible capital expenditures.

- Navigate elections and group rules to preserve SR&ED access.

- Stay compliant and minimize CRA audit risk.

The SR&ED program is now more valuable than it’s been in over a decade. Contact Kreston GTA LLP today to see how these changes could enhance your next claim.